AI Contract Analysis for Professionals

Upload any contract → Get instant analysis → Make confident decisions

Perfect for: Startup Founders • Freelancers • Real Estate Investors • Procurement Teams • HR Managers • Small Business Owners

Understand Any Contract in 30 Seconds

Stop reading contracts line by line. Get instant AI analysis, identify risks, and make informed decisions faster than ever.

Research Contract Terms & Standards in Seconds

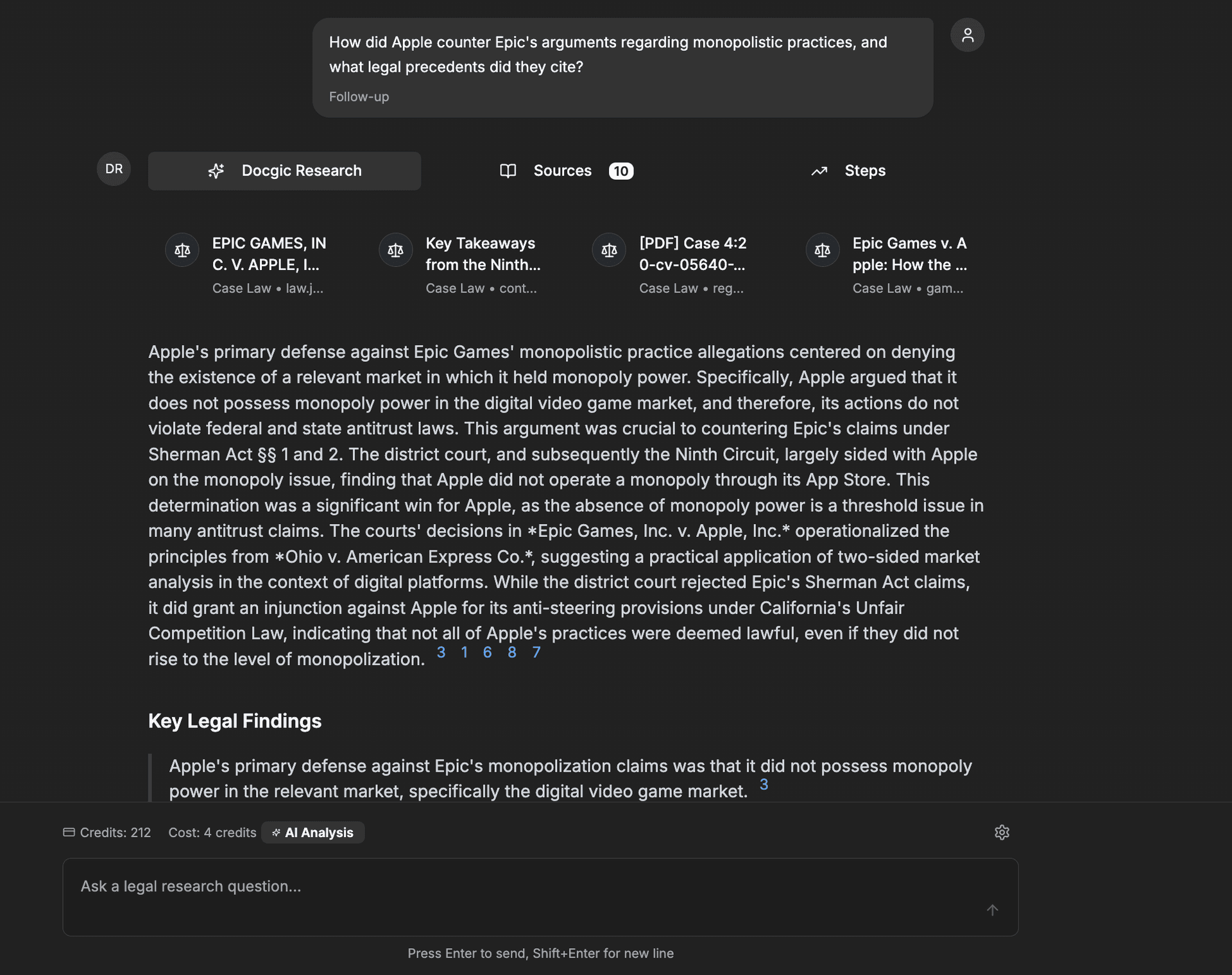

Find standard terms, regulatory requirements, and industry benchmarks. Get comprehensive research with sources and analysis instantly.

Industry Standard Research

Ask questions about standard contract terms, payment terms, indemnification clauses, and get comprehensive analysis with sources cited.

Regulatory Requirements

Get answers about GDPR, data processing requirements, and compliance standards relevant to your contracts.

Contract Best Practices

Learn about standard terms, red flags to watch for, and industry benchmarks for your specific contract type.

Chat with your contracts and get instant answers

Ask questions in plain English. Get answers backed by specific sections of your documents.

Understands Contract Language

Our AI understands contract terminology like force majeure, indemnification, termination clauses, and payment terms.

Section-Backed Answers

Every answer comes with direct references to specific sections, so you can verify and understand exactly where the information comes from.

Compare Multiple Documents

Find inconsistencies between contracts or track changes across versions of the same agreement.

Compare contracts and track every change

Never miss a modification. See exactly what changed between contract versions with visual highlighting.

Never Miss a Change

Automatic version tracking ensures you catch every modification in contracts, eliminating costly oversights.

Identify Risky Modifications

Visual highlighting makes problematic changes obvious, even in complex contracts with hundreds of revisions.

Document Research Integration

Automatically detect and enrich citations with metadata from trusted databases.

- Automatic citation detection

- Citation enrichment

- Comprehensive case information

Advanced Analytics

Gain insights into your document analysis patterns and track your legal workflow efficiency.

- Document analysis insights

- Workflow efficiency tracking

- Performance benchmarking

Enterprise-Grade Security

Designed for professionals with strict confidentiality requirements and data governance needs.

- End-to-end encryption

- Secure document isolation

- Audit trails for all document access

Simple, Transparent Pricing

No complicated billing. No surprise charges. Just transparent pricing for professionals who need contract analysis.

Starter

FREE

Perfect for occasional contract review

- Document analysis

- Chat with documents

- Contract research

- Industry standard search

- Document organization

Professional

$29.99

For freelancers, consultants, small business owners

- Advanced document analysis

- Enhanced document comparison

- Contract research & standards

- Version comparison

- Priority support

Business

$99.99

For companies, procurement teams, law firms

- All Professional features

- Custom integrations

- Extended data retention

- Dedicated support

- Enterprise-grade security

How Docgic Works

Get started with Docgic in just a few simple steps.

Upload Documents

Upload your documents to our secure platform. We support various formats including PDF, DOCX, and more.

AI Analysis

Our AI automatically analyzes your documents, extracting key information, identifying clauses, and preparing them for interaction.

Analyze & Export

Chat with your documents, compare versions, generate detailed reports, and export your findings in various formats.

Ready to Transform Your Document Workflow?

Join the professionals who are saving time and gaining insights with Docgic.

Connect with the Creator

Have questions or feedback? Let's connect on social media.

Have feedback or questions?